If there is a court order requiring that a military member pay child support or alimony and the member doesn't pay, what will the military do to force them to pay?

The first questions is how much should you be paid? This is typically determined by a court order or a written agreement between the parties. If you don't have a court order, see our article on Dependent support regulations. These are service specific, so pick your service. Members of all services have obligations to provide minimum levels of support. Read more about your service here:

If you have a court order, you should be paid the amount in accordance with your court order, but what if the service member still won't pay you what you are owed?

Let's start where most spouses start: Often we hear about spouses complaining, or threatening to complain, to a commander about their spouse and expecting the commander to force their subordinate to pay. Every branch requires that service members supports their dependents and make failure to do so punishable under the UCMJ and by administrative action. However, Commanders have no authority to direct a garnishment or directly cause the member to pay. At best, the commander can order the member to pay and then punish the member if they don't follow the order under Article 92, UCMJ. This basically attempts to coerces the member into paying. However, just because commanders can punish, doesn't mean they will punish. Commanders are not obligated to try to enforce your court order and most don't really want to get into the middle of their subordinates personal lives, so unless there is something particularly egregious about your situation they may not get involved. Further, even if they do get involved and punish the member, spouses don't have the right to know what happened because administrative actions protected by the Privacy Act. So, while a spouse may complain to a Commander and the Commander may even act on the complaint the spouse is unlikely to know what, if anything, happened. You might think that goes against everything you think should happen or how it should work, but honestly, what other employer would you complain to about this and expect them to do anything? I'd guess none.

So, what recourse do spouses have when the servicemember won't pay?

Two options: garnishment and a statutory allotment.

Note: If your ex is more than two months behind on payments, skip down to allotments, it's a simpler process.

Garnishment:

With a valid garnishment order from a state court, the Defense Finance and Accounting Agency (DFAS) will place a garnishment on the pay of active duty, Reserve, or Guard and retired military personnel for the amount of your child support and/or alimony. In order to get them to do this, you must meet all the requirements.

Note: It isn't your spouse's commander, the finance office, or even the individual service that will garnish military pay, it is DFAS.

Here are the steps:

You must get a court order from a court or child support enforcement agency (CSEA) that directs the government to pay monies for support or alimony. Typically, this is called an "Income Deduction Order" or "Income Withholding Order" (more about this below). Different states have different rules about what is required for these orders to be enacted. Some states will do it automatically on request for child support orders. It tends to be harder to get these orders for alimony alone. In order for DFAS to act on the order, it must state:

the member’s full name,

date of birth,

social security number,

current military status and,

if known, the member’s current assignment.

Note: An "Income Deduction Order" or "Income Withholding Order" is different than your divorce decree or custody order.

Once you have the above, send the income withholding order or similar document to DFAS at the address or fax number below. You do not need to send the underlying order, (e.g., a divorce/separation decree). You should include a return address on all correspondence, not just the return envelope.

Garnishment Operations-HGA,

P.O. Box 998002

Cleveland OH 44199-8002.

Faxed to 877-622-5930 (toll free).

Note: Federal law prohibits the garnishment from equaling more than 50% of a servicemember’s aggregate disposable earnings if the member is supporting a second family or 60% if the member is not. This percentage can increase by 5 percent if the arrearage is 12 weeks or more.

If you want to send the information via Fax, make sure you check out the latest guidance here so it isn't rejected.

About the Withholding Order:

As stated above, your withholding or garnishment order IS NOT and CAN NOT be the divorce decree or other order that directs the individual (obligor) to make the payment. Rather, the order must direct the government, as the employer, to withhold money and remit payments to satisfy the support obligation. The withholding order need not name the specific government office in which the obligor is employed, but it must provide the following information:

the obligor's full legal name

the obligor's social security number

Under federal regulations, "child support" can include such items as court costs, administrative fees, and attorney's fees so those items can now be collected if the withholding order directs them to be. DFAS does not charge a fee for honoring income withholding orders for child support, alimony or related arrearages (overdue support or alimony payments).

Want to know the Pay Schedule and/ or set Direct Deposit?

For information about pay dates and establishing direct deposit, please visit the following page: Payment Information

Questions/ More information about garnishment?

If you have questions about child support or alimony, call DFAS at 888-DFAS-411 or 888-332-7411.

Statutory Allotments:

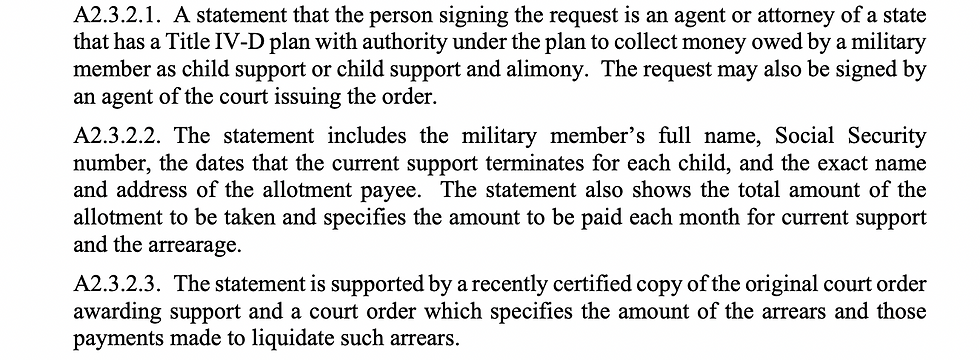

If you don't want to get a garnishment, and the servicemember is over two months behind on their child support and alimony payments federal law authorizes allotments be taken from their active duty military pay in order to satisfy these payments. Alimony alone does not qualify under this law, it must be accompanied by a child support order. Statutory allotments may only be paid from active duty pay, so this won't work for retired, reserves (unless activated) or guard. To start an allotment, you must send DFAS a written notice from a court or state agency administering the child support program in your state. The notice must be signed by an authorized official and contain the information listed in DAFI 36-2906 Attachment 2, para. A2.3.2.

Important Notes:

Allotments cannot exceed 50 percent of a member’s pay and allowances if the member is supporting a second family. If the member is not supporting a second family, the allotment may not exceed 60 percent. The percentage may be increased by 5 percent if the arrearage is 12 weeks or more.

After DFAS receives the request they notify the member’s commander. The commander will then notify and counsel the member. The member has 30 days to cure the arrearage or to submit evidence that the arrearage is an error. If not, Defense Finance and Accounting Service will ordinarily implement the allotment 30 days after the member’s notification. Payments begin at the end of the month in which the allotment is to be effective.

States may have law that are more restrictive than the federal law. oIf a state has set a lower limits on for the maximum amount that can be garnished, .this will likely override the federal maximum.

Have more questions? Reach out!

Want to stay updated on our latest articles? Subscribe and become a site member, it's free! We'll email you when new articles come out!

You can also like us on Facebook!

Comments